Does the adage "one man's trash is another man's treasure" apply to junk grade debt? On Friday, March 17, Moody's released updated ratings on a 2013 vintage CMBS trust. Four tranches, with balances totaling over $150mm, received downgrades. One of the key reasons cited was a $9.9mm loan on the Pipeline Village retail center in Hurst, Texas.

Making up 1.5% of the total CMBS pool, Pipeline Village, located Northeast of Fort Worth, struggled during the early days of Covid. The 133,326 SF retail center has been in special servicing since August 2020 and, as of this month, is classified as REO.

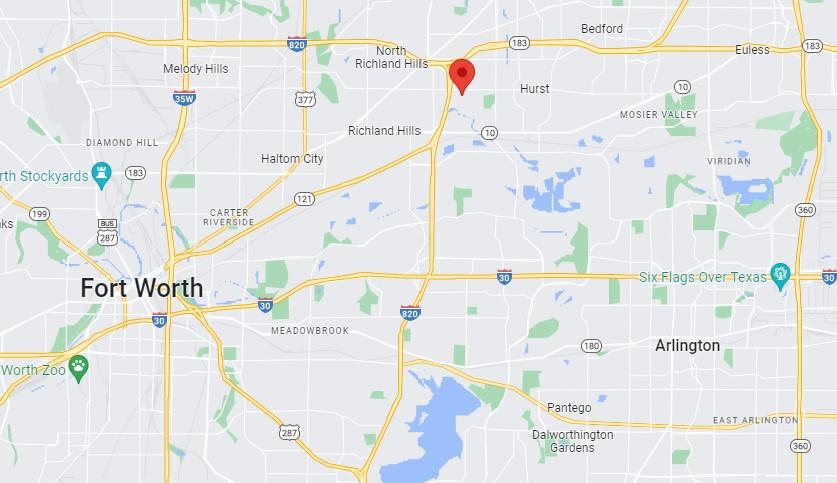

Pipeline Village's location in Hurst, Texas is located in a suburban area of the metroplex.Google Maps

Pipeline Village's location in Hurst, Texas is located in a suburban area of the metroplex.Google Maps

This downgrade comes on the heels of a devastating blow to the retail center's prospects. Discount home goods retailer Tuesday Morning, a key tenant for the asset, announced their second chapter 11 bankruptcy since 2020. As part of Tuesday Morning's restructuring, they will be closing half their retail locations, including the Pipeline Village location. Moody's did not cite a current appraisal of the property, but expects "a significant loss on this loan".

While many tranches, including two that were downgraded, remain classified as investment grade, the increased risk is relevant to all investors. Future investors in all tranches may demand higher risk premiums in the future, creating a ripple effect throughout capital markets across the country. This is relevant to all investors because higher risk premiums lead to higher cost of debt, leading to higher weighted average cost of capital (WACC), leading to higher cap rates, and, ultimately, leading to lower valuations, especially for retail centers such as Pipeline Village.

Opportunistic investors may see potential in these macroeconomic trends. Just as high-yield fixed income investors may be delighted to see these downgrades, savvy CRE investors may interpret the declining valuations as an overcorrection in the market and, in turn, an opportunity to pick up discount assets. For long term investors concerned more with yield than current market values, if you liked it at a 6.50% cap you'll love it as a 9.00% cap (and figure out a way to explain that to your LPs and lenders).