In February 2023, Moody's Investors Service upgraded their rating for multifamily REIT Mid-America Apartments, LP (MAA). The rating, which is based upon the company's senior unsecured debt, was upgraded from Baa1 to A3 -- a substantial move given that Baa is the final investment grade rating that Moody's offers (no one wants their company downgraded to junk). As the name may imply, MAA's portfolio is focused upon the hot Sunbelt market (pun fully intended). Notably, 8.90% of their NOI comes from the Dallas market.

While there are company specific factors at play, such as conservative leverage and geographic diversity, the strengths of Dallas and similar markets are on full display. Commentary released April 12, 2023 notes secular trends at play in Dallas and the rest of the Sunbelt that factored into the rating:

Mid-America's markets are poised to benefit from net positive migration from coastal markets, a trend that was accelerated by the pandemic and remote work policies as renters relocated to more affordable cities. US migration patterns to the Sunbelt is a long-term trend that precedes the pandemic. Favorable trends in employment, demographics and business-friendly regulation have enabled strong in-migration and pent up demand for apartment rentals. The Sunbelt has also experienced the biggest increase in rents among all regions in the US.

Moody's notes that the Sunbelt states' share of the US population has reached 34.6%, with a number of states, Texas included, seeing >10% population growth from 2010-2020. Additionally, the lack of income tax in Texas and its peer states is also cited as a factor driving growth.

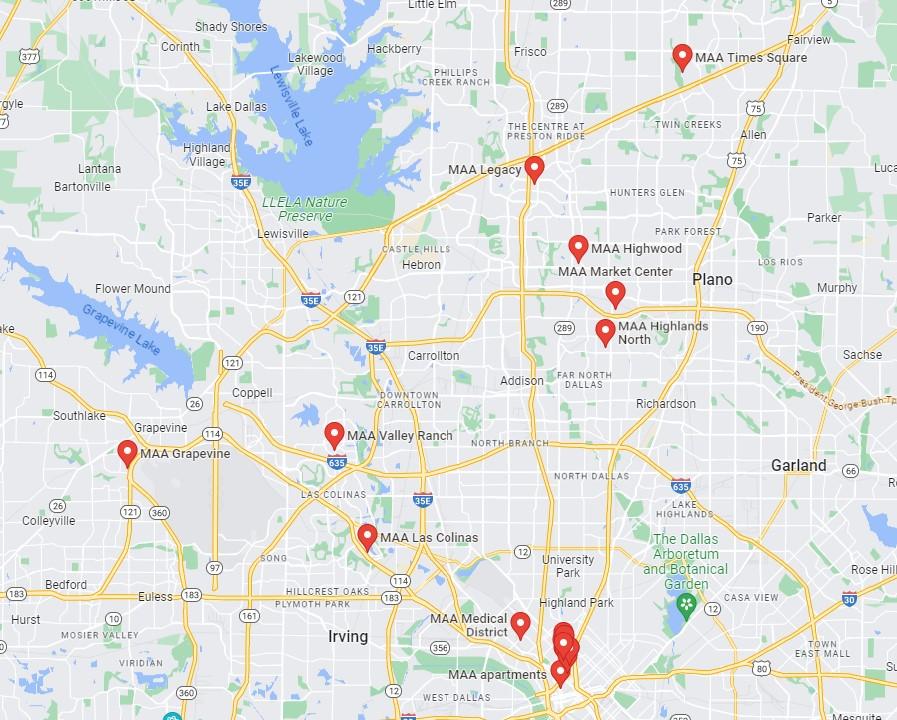

MAA has a strong presence in the Dallas multifamily market. The bulk of their local assets are located in the McKinney area Uptown.Source: Google Maps

MAA has a strong presence in the Dallas multifamily market. The bulk of their local assets are located in the McKinney area Uptown.Source: Google Maps

In a period of rising interest rates and increasing uncertainty around CRE valuations, a ratings upgrade for a REIT with significant exposure to the Dallas multifamily market should grant at least some relief to nervous owners. The confidence of investors carries with it both great weight and advantageous financing.

Although multifamily tends to be one of the most resilient of CRE asset classes, most, if not all asset owners in the Metroplex benefit from the same factors that led MAA to this upgrade.