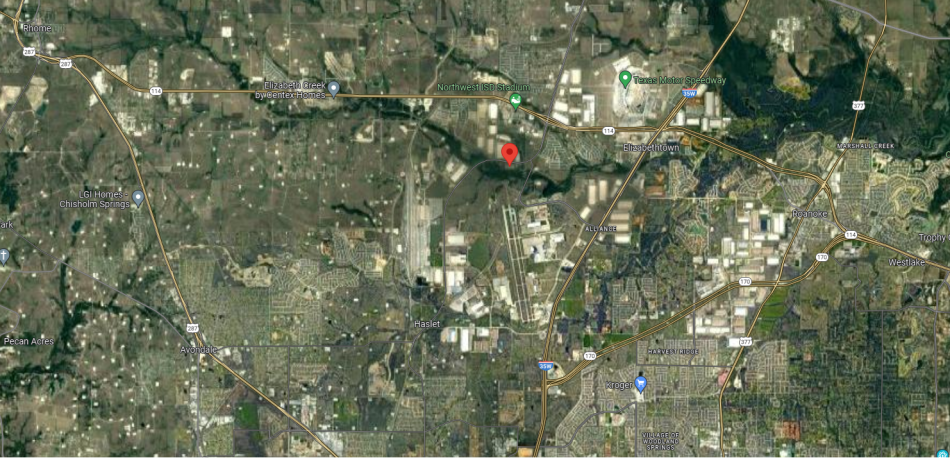

On August 28, 2023, Atlanta-based Stonemont Financial Group announced the sale of a 213,581 SF industrial asset to Victaulic, a Pennsylvania-based pipe-joining manufacturer that serves markets around the world. The warehouse's location at 15550 Blue Mound Road is prime, offering convenient access to the Fort Worth Alliance Airport, BNSF's intermodal rail hub, I-35, and State Road 114.

The asset was constructed by KBD Group and designed by RGA Architects, a Metroplex-based architecture firm who also designed the Farmer Brothers' HQ. In the transaction, Stonemont was represented by KBC Advisors and Victaulic was represented by Lee & Associates.

Initially a speculative development (although industrial demand in the Alliance area has been a pretty safe bet), Victaulic and Stonemont reached an agreement in November, 2021, shortly after construction began. The industrial manufacturer will enjoy 213,581 SF, including office space, as well as 98 parking spaces, 35 trailer stalls, and 38 dock doors. The building, which is Victaulic's first in Texas, will be used for both manufacturing and distribution of products within the Texas market.

Josh Wheeler, Senior Vice President as Stonemont, spoke to both the investment thesis and Victaulic's value as a client:

Our team at Stonemont remains bullish on North Texas due to its strong market fundamentals, and this project is a testament to the area’s attractiveness for top-tier businesses looking to establish a footprint in the state. We felt confident in investing in the Fort Worth market due to its abundant labor supply and premier access to major transportation routes, and our optimism paid off when Victaulic reached out to us. They have been an incredible client to work with, and we are proud to play a role in their growth story as they expand their reach into the Lone Star State.

The substantial interior volume should ensure Victaulic isn't left wanting for spaceSource: KDB Group

The substantial interior volume should ensure Victaulic isn't left wanting for spaceSource: KDB Group

Contrary to Victaulic, this is far from Stonemont's first rodeo in The Lone Star State (pun very painfully intended). The REPE firm boasts over 2mm SF of development in Texas, including the Austin metro area alongside the DFW. Their optimism in the market is certainly not unfounded: according to Cushman & Wakefield, over 11.5mm SF of industrial leases were inked in Q2 of 2023 alone, bringing 2023's first-half absorption to a staggering 20mm+ SF. Should this trend continue, undeveloped green fields in the Alliance area may soon become a thing of the past.

Texas' continued growth, fueled by business-friendly lawmakers, continues to draw even more demand for industrial space in the DFW area, especially in the Alliance area. The Metroplex's prime road, rail, and air connections, combined with its central geographic location, attract demand to such an extent that it almost seems like CRE capital markets are operating smoothly.