In December 2023, ARCTRUST Private Capital, the capital markets division of the ARCTRUST Group of Companies, announced a $14.95mm offering of preferred equity for a 288-unit, Class-A multifamily community in Burleson, Texas. The offering, which is available to accredited investors with a minimum $50,000 investment, will help fund the 23-acre development located at 1151 Easton Rendon Crowley Road. The property will be developed by Rendon Residential Partners LLC, a joint venture between ARCTRUST and Landmark Companies.

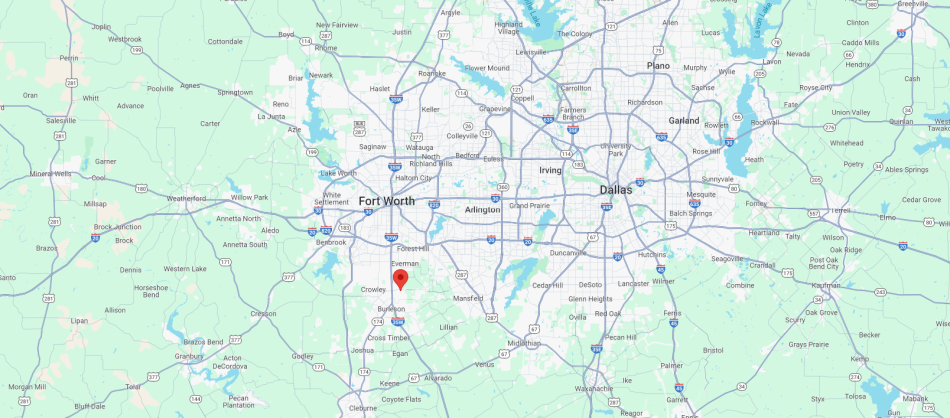

Rising property values have pushed more and more Class-A development to DFW suburbs like BurlesonSource: Google Maps

Rising property values have pushed more and more Class-A development to DFW suburbs like BurlesonSource: Google Maps

The 288 residential units will be spread out between 12 separate 3-story buildings, making full use of the 23-acre parcel. The planned unit mix is one and two-bedroom units. Amenities will include a clubhouse, fitness center, pool, outdoor grill and picnic areas, and a dog park.

Chris Wadelin, CEO of ARCTRUST Private Capital, believes DFW's hot single family housing market has created new demand for multifamily communities such as this:

We believe that the Greater Dallas metropolitan region offers some of the most compelling multifamily investment opportunities in the country. Population migration is attracted to this area based upon proximity to the Dallas Metroplex, high job growth, and relatively low cost-of-living. High home prices and limited for-sale single-family homes will encourage them to remain in well-appointed and well-located multifamily communities for longer periods. Project Rendon not only helps to meet this anticipated demand from residents, but we believe it offers impressive income opportunities for our investors.

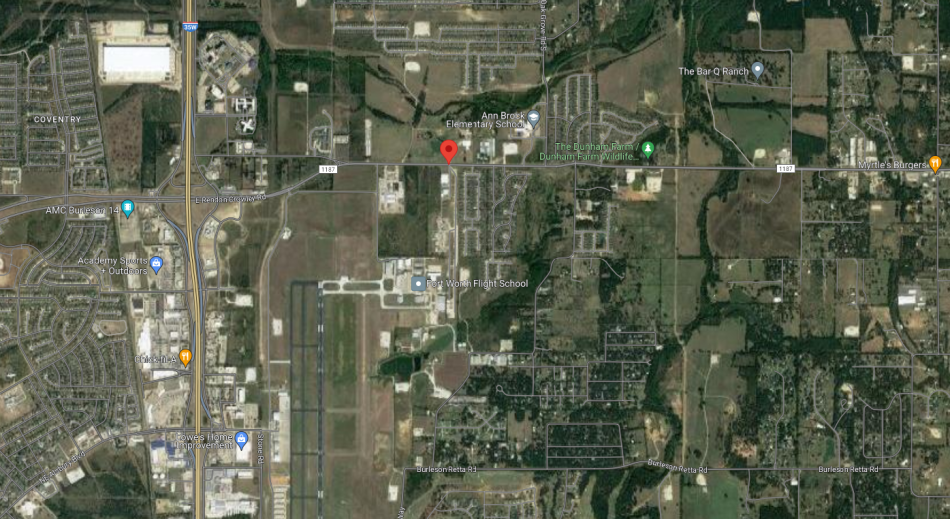

There is certainly an argument to be made in favor of Class-A suburban multifamily complexes as rising mortgage rates have yet to make a dent in single family housing prices. Located right next to an elementary school, this project could find itself as a prime option for young families who have delayed purchasing a home for themselves. The adjacent airport, however, may not be ideal for those with infant children.

The property is nicely situated near an elementary school and a short drive from retail. The adjacent airport, however, will likely be polarizingSource: Google Maps

The property is nicely situated near an elementary school and a short drive from retail. The adjacent airport, however, will likely be polarizingSource: Google Maps

Preferred equity offerings can be a great way to finance real estate projects, especially new developments. Risk-averse regional banks, many of whom have been left overexposed at higher LTVs than underwritten as cap rates have expanded, may not provide adequate debt to increase a developer's equity return. Preferred equity can bridge the gap created by the tightened purse of banks, giving common equity the higher (albeit riskier) returns required for such a project. Additionally, preferred equity can be a great way for small-scale investors to gain exposure to private real estate developments, especially as beginners, in a superior position within the capital stack.