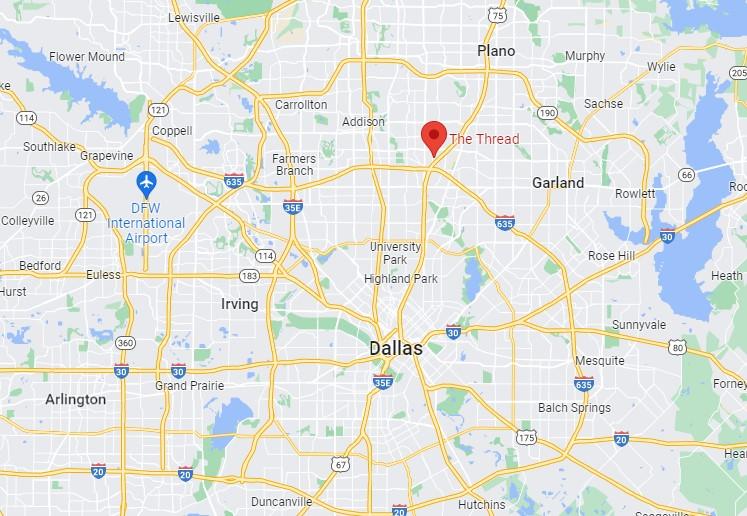

In June 2023, Brazos Residential, a Dallas based real estate private equity firm, announced their acquisition of The Thread, a 606 unit multifamily complex located near the Dallas/Richardson border. The asset, located near the Texas Instruments HQ near both US-75 and the LBJ Freeway, was constructed in phases between 1969 and 1978. Northmarq's Dallas office facilitated the transaction, with Taylor Snoddy brokering the sale and Kevin Leamy arranging financing.

Despite only being founded in 2022, the thread is Brazos' 16th acquisition and 6th in the Metroplex area. The fund is focused on the white-hot sunbelt market, holding 3300+ multifamily units valued at over $404mm. Within the sunbelt market, Brazos has focused primarily on Texas and North Carolina.

James Roberts, managing partner and co-founder of Brazos, spoke to the unique deal characteristics that made The Thread an attractive opportunity:

The Thread has several unique characteristics that make it an exciting opportunity for the partnership. We were able to secure the asset off-market at a great basis through our local broker relationships. The Thread recently emerged from a Land Use Restrictive Agreement (LURA) which allows us to create immediate value by switching to fully market rates. We are equally excited to make a positive impact for the residents and community through property-level improvements.

The introduction of market-rate rents is a quick way to immediately impact the bottom line for an asset, although that prospect was likely priced into the transaction. However, unrestricted rents allow for asset managers to pursue value-add opportunities to maximize the asset's potential. While specific renovation plans were not discussed in the release, the property's 50+ year age likely offers opportunities for renovation.

Investors are eager to gain exposure to value-add opportunities such as The ThreadSource: Brazos Residential

Investors are eager to gain exposure to value-add opportunities such as The ThreadSource: Brazos Residential

The Brazos team believes they can take advantage of synergies with their other area assets to maximize efficiencies and create value for their investors. William Hancock, also a managing partner and co-founder of Brazos, spoke to the network effect on the portfolio:

We possess an intimate knowledge of the Dallas/Fort Worth market and are thrilled to add this asset to our portfolio. The proximity of The Thread to other Brazos Residential properties and our corporate headquarters presents strategic synergies, supporting the expansion of our portfolio in our own backyard.

Investors in all asset classes can look to this deal as a case-study in the importance of networking. Off-market transactions can offer unique circumstances for savvy investors.

Real estate markets' illiquidity and informational inefficiencies stress the importance of relationships in the industry. Unlike publicly traded equities, real estate markets often offer situations in which investors can earn outsized risk-adjusted returns through their network and ability to move quickly toward a deal.