In August, 2023, Berkadia began marketing a unique multifamily portfolio in Downtown Dallas on behalf of Toronto-based Brookfield Asset Management. The four-building portfolio, known as Mercantile Place, offers 704 multifamily units as well as retail and office space. All four properties are currently managed by NYC-based Brookfield Properties, a subsidiary of Brookfield Asset Management. It is unclear if new property management is expected post-transaction. Berkadia's Thad Wetterau is the lead advisor on the deal.

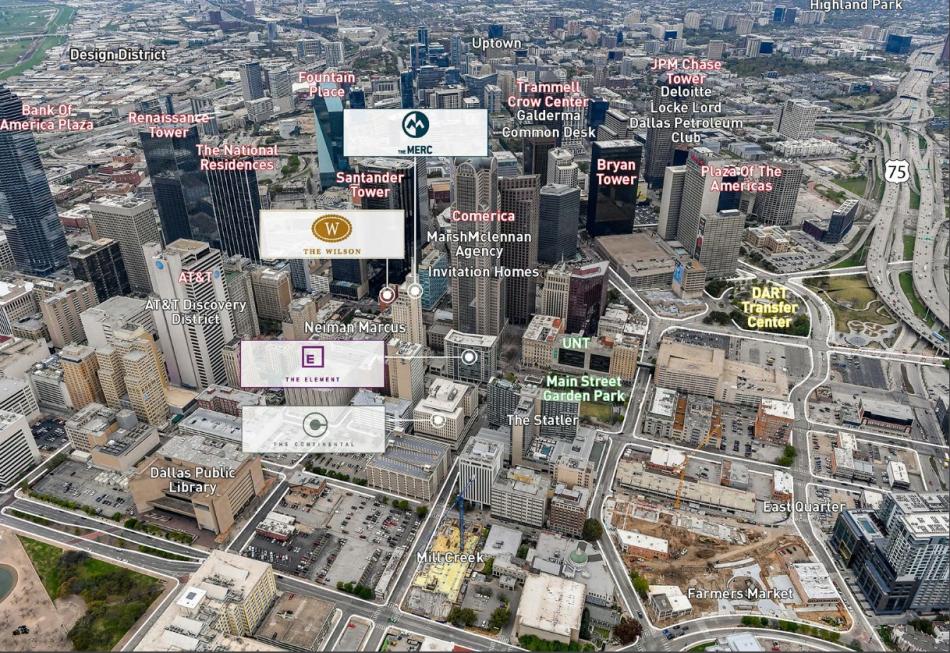

The portfolio is in a prime position to benefit from the revitalization of Downtown DallasSource: Berkadia

The portfolio is in a prime position to benefit from the revitalization of Downtown DallasSource: Berkadia

The oldest of the properties is The Wilson, built in 1904 as an office building for its namesake, JB Wilson. Upon completion, the building was the tallest in Dallas, albeit only until 1909. With design inspired by the Paris Grand Opera House, the building was added to the National Register of Historic Places in 1979, 75 years after its construction. In 1999, the building was converted into a multifamily building, boasting 135 apartments as well as over 10,000 SF of retail space on the ground floor. It was most recently renovated between 2008 and 2010.

Despite being well over 100 years old, The Wilson's turn-of-the-century architecture has aged like fine wineSource: Wikimedia Commons

Despite being well over 100 years old, The Wilson's turn-of-the-century architecture has aged like fine wineSource: Wikimedia Commons

The next oldest in the portfolio is The Merc, also known as the Mercantile National Bank building. The iconic clock tower has been a staple of the Downtown Dallas skyline since its construction in 1943. Undeterred by the Second World War, the 31-story office tower stood as the tallest building west of The Mississippi until 1954. In 2006, the building was designated a Dallas Landmark.

In 2008, The Merc underwent a conversion from office to multifamily -- between its construction during World War II and renovation during the Financial Crisis, global tumult seems to be a catalyst for capex at 1800 Main St. The building was renovated to offer 213 apartment units and over 8,000 SF of retail space. Unlike The Wilson, The Merc retained 34,000 SF of office space during the conversion.

The Merc has been a staple of Downtown Dallas since it was constructed in the middle of WWIISource: UT Austin Library

The Merc has been a staple of Downtown Dallas since it was constructed in the middle of WWIISource: UT Austin Library

The Continental, built in 1948, offers unique challenges and opportunities for a prospective buyer. Built in 1948 with just three-stories of offices, The Continental holds the distinction of containing the first underground parking garage in Dallas. In 1958, eight additional stories were added and, in 2013, the building was converted into 203 apartment units. Unlike the other assets in the portfolio, The Continental's HUD loan requires 20% of the units, or 41 in total, to be priced affordably. Even if refinanced, the 80% AMI rent limit on these units will remain in place until September, 2026 at the earliest. With huge sums of both private and public money pouring into Downtown, a savvy investor may find 2026 to be a perfect time to take advantage of a renewed market.

While perhaps not as visually striking as The Wilson or The Merc, The Continental's unmistakably mid-century styling makes it stand out from more modern buildings.Source: Brookfield Properties

While perhaps not as visually striking as The Wilson or The Merc, The Continental's unmistakably mid-century styling makes it stand out from more modern buildings.Source: Brookfield Properties

The final asset in the portfolio is also the only asset constructed after Neil Armstrong walked on the moon. Built in 2007, The Element is unique in the portfolio for more than just its age: it was the only of the four assets to be constructed from the ground up with multifamily as the intended purpose. The Element's 150 apartment units are complemented by over 6,000 SF of retail space and over 2,000 SF of office/coworking space. Berkadia notes the office space could be converted into three apartment units should a buyer choose to do so.

The sale of these assets should serve as a litmus test for investor's faith in Downtown Dallas. Plagued by crime, Downtown Dallas' current state likely deters many would-be residents from paying a premium. Projects such as AT&T's Discovery District give hope for a Downtown-turnaround, but it is an uphill battle. The City of Dallas' 2023 Community Survey provides a sobering statistic: a staggering 67% of residents do not feel safe Downtown after dark.

On a more positive note, liquid markets for Downtown assets should bring new investors to the market and continue to align private and public incentives. Although value-add by way of neighborhood revitalization may seem a quixotic endeavor at first, the past two decades' $400mm of public investment in Downtown Dallas has been complemented by an outsized $5.4bn in private investment. Investors clearly see the potential in the area and, with rapidly appreciating property all throughout The Metroplex, the private incentive to fix Downtown has never been greater.