On April 5, 2023, MDH Partners, an Atlanta-based REPE firm, closed on a Texas-sized industrial asset south of downtown Fort Worth. The facility, creatively named "Fort Worth Logistics Hub, Building 1," is located at 9450 Burleson Cardinal Road within the Fort Worth city limits. The building's 617,914 SF cover just about 40% of the 39 acre lot on which it is built. Eastdil Secured advised the seller in this $67.5mm transaction.

The asset is 100% leased by Samsung SDS America, a wholly owned subsidiary of Samsung SDS (formerly Samsung Data Services). The tenant utilizes big data, proprietary cloud platforms, and AI (the buzzword du jour) to maximize shipping efficiency for its clients. This has been a fruitful endeavor, with their annual revenue growing from $850mm to $1.6bn since 2019. In other words, the business plan is solid and the financial backing is there: they are a credit tenant.

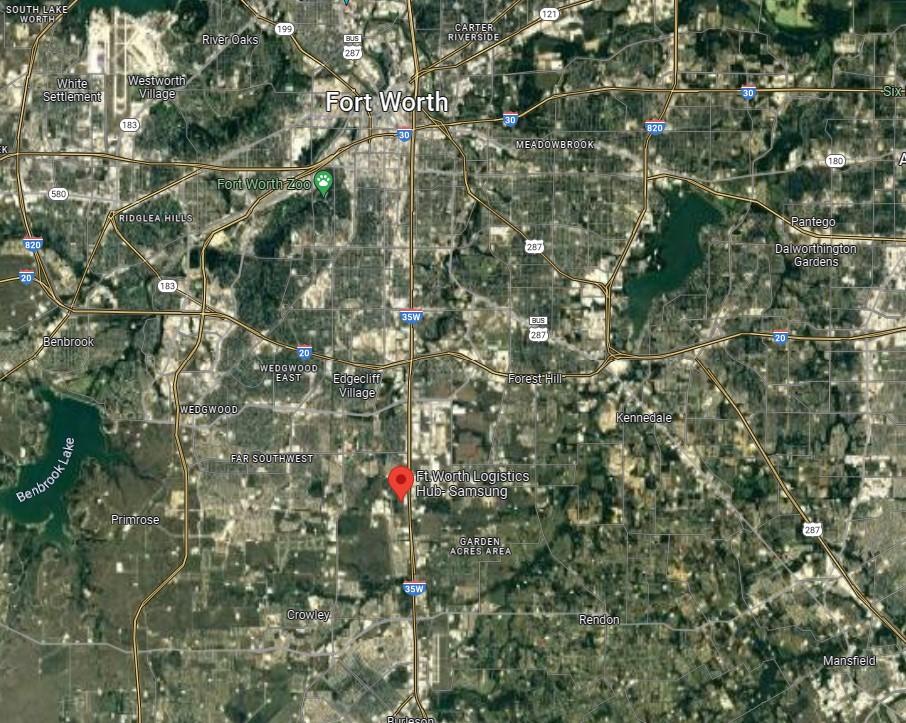

Although not the most convenient location relative to the airports, the facility is convenient located next to I-35Source: Google Maps

Although not the most convenient location relative to the airports, the facility is convenient located next to I-35Source: Google Maps

Delivered in 2022, the facility is fresh new supply for the metroplex's ever scarce class-A industrial asset class. Despite being located far south of the Fort Worth Alliance and DFW airports, the facility enjoys convenient access to I-35 and I-20. Additionally, 36 foot ceilings and 245 parking spaces promise to keep the building adaptable to changing needs of the future.

With this acquisition, MDH Partners now owns over 3.3mm SF of industrial assets in Texas, with about 1.6mm SF in the DFW area alone. Joe DeHaven, Senior Managing Director and acquisition lead for this project, has strong faith in the local market, stating:

Dallas-Fort Worth remains a strategic market for us, and is a key logistics hub serving both the growing metro population and the surrounding region. With some economic uncertainty looming, one of our focuses currently is to pursue long term leased newly constructed buildings in tier 1 sunbelt markets, and this asset fits that profile well.

Joe is not alone in his beliefs: in Q4 2022, despite market uncertainty, DFW saw 10.2mm SF of industrial space absorbed. For investors with dry powder ready to deploy, these industrial assets in the are an understandably attractive asset. DFW industrial growth is driven not only by the economic and population growth of the area, but also by its central location and key transportation hubs. For national logistic needs, the metroplex's central location complements its air, rail, and road connections to make it a top choice.

Sources not linked:

https://www.samsungsds.com/en/investor/financial_info/reviewed-financial-statements.html