According to a Newmark, Franklin Street Properties Corp (NSYE: $FSP) has succeeded in putting the Collins Crossing office building, a 1999-vintage asset in Richardson, under contract to sell. Located at 1500 N Greenville Ave, the 300,000+ SF office offers its buyer an enticing proposition: 85% occupancy with credit tenants plus 3.6 extra acres along with it. As expected in the Dallas market, parking is also ample: 1116 spots split between 203 surface and 963 structured. No financial details were given regarding the transaction.

The property, which features a full-service deli, conference center, outdoor amenity space, and fitness center, has fared well since 2020. According to Newmark's listing, the building has a strong group of credit tenants:

- Argo (software solutions) | 85,650 SF | 6.9 years remaining

- id Software (video game developer) | 57,100 SF | 5.7 years remaining

- Dell EMC (data storage/cloud computing) | 57,100 SF | 1.0 year remaining

- Nexperia (semiconductor manufacturing) | 28,550 SF | 10.2 years remaining

- Compassus (home healthcare) | 11,395 SF | 2.3 years remaining

While not as flashy as some office lobbies, Collins Crossing's lobby still does more than the bare minimumSource: Franklin Street Properties Corp

While not as flashy as some office lobbies, Collins Crossing's lobby still does more than the bare minimumSource: Franklin Street Properties Corp

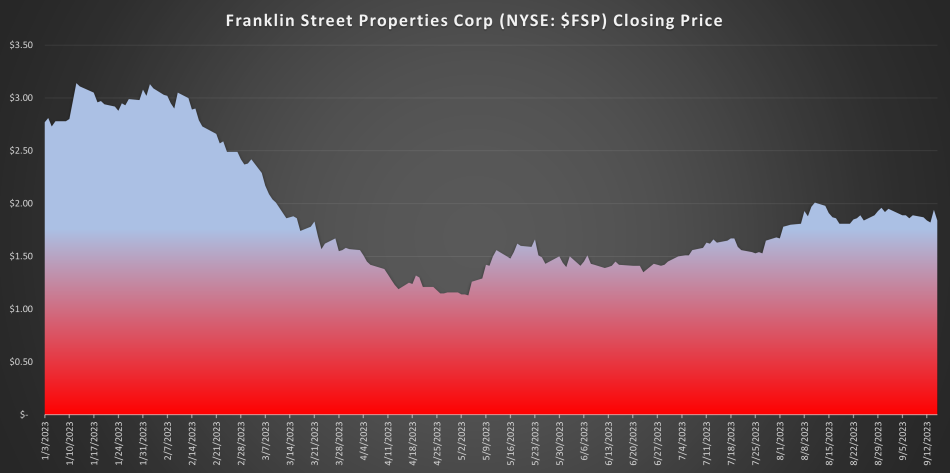

According to Dallas County tax records, Franklin Street has owned the asset since 2004. The sale of a stabilized asset is in line with commentary from George J. Carter, chairman and CEO of Franklin Street, given in their Q2 earnings release last month:

As the third quarter of 2023 begins, we continue to believe that the current price of our common stock does not accurately reflect the value of our underlying real estate assets. We will seek to increase shareholder value by (1) pursuing the sale of select properties where we believe that short to intermediate term valuation potential has been reached and (2) striving to lease vacant space. We intend to use proceeds from property dispositions primarily for debt reduction.

It is not a stretch to believe Collins Crossing is one of the properties where value has been created. Newmark's OM states 117,357 SF of leases have commenced in the past 10 months. With a Q2 2023 net loss of $8.24mm, the cash from the sale should help them extract the value they have created and give them additional liquidity.