On June 28, 2023, Japanese retailer Daiso announced the establishment of a new distribution center. The 350k SF building, constructed in 2022, is located at N 1600 Polk Street in DeSoto, TX, where it enjoys convenient access to both I-20 and I-35. Dallas County records indicate the building is currently owned by California-based asset manager Wilshire. It is unclear if Daiso has leased the entire space -- LoopNet shows lease sizing between 100k and 350k SF..

Daiso will be working with Flexe and JT Logistics to ensure the potential of the space is maximized when operations commence in July, 2023. Marie Christenson, VP of Supply Chain for Daiso, spoke to the aforementioned potential:

We are thrilled to announce the opening of our new distribution center in Texas. This facility will not only enable us to enhance our operational capabilities but also ensure timely and efficient delivery of our products to our valued customers. We are excited to partner with Flexe and JT Logistics, and we are confident that their expertise will play a crucial role in our growth strategy.

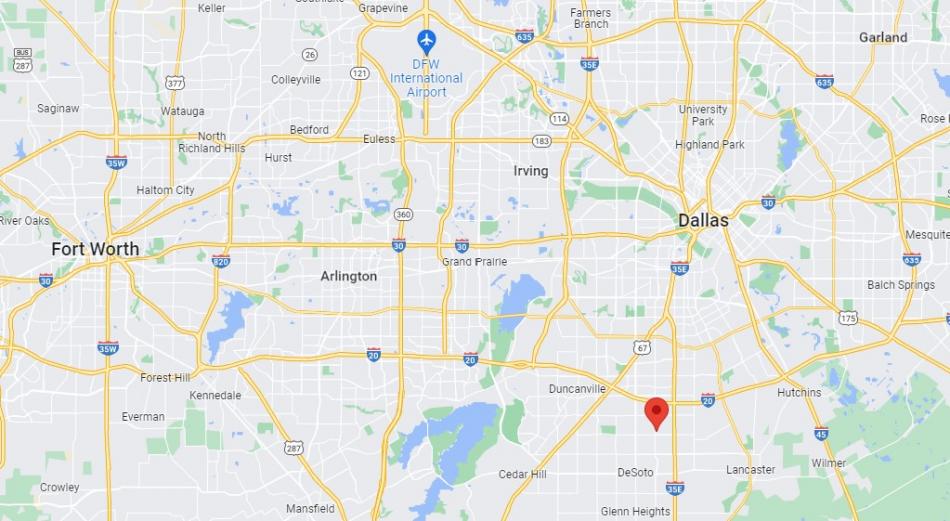

While not particularly close to the DFW or Alliance airports, the facility enjoys easy access to key highway arteriesSource: Google Maps

While not particularly close to the DFW or Alliance airports, the facility enjoys easy access to key highway arteriesSource: Google Maps

The asset's location is a key selling point. Easy highway connections allow for goods to be distributed easily via truck while The Metroplex's central location ensures efficient nationwide distribution. Additionally, the asset is triple freeport tax exempt, offering major tax benefits to distributors who move their goods out of Texas within 175 days.

The property's 350k SF footprint sits on a 18.46 acre lot, offering plenty of extra space. This excess land allows for the 36' ceilings to be complemented by 60 docking bays, 179 parking spots, 28 dock levelers, and about 3300 SF of office space. Parking for 69 trailers ensures space will likely never be an issue and, if it does become one, there is plenty of space for more blacktop.

Function over form is the name of the game for industrial assets. That said, this is pretty good looking for a rectangular box.Source: LoopNet

Function over form is the name of the game for industrial assets. That said, this is pretty good looking for a rectangular box.Source: LoopNet

The DFW area continues to be a top choice for both domestic and international companies looking for industrial space. Class A industrial space, especially flex-industrial equipped with built-in office space, remains a hot commodity even as other deal-making slows down. Excellent industrial assets built with flexibility for the future are admittedly not the sexiest of deals. However, institutional investors, whose cost of capital often allows for lower cap rates and higher valuations, value these assets' credit tenants and their reliable cashflows.

For more exciting industrial deals, investors can jump into the saturated market of restaurants situated within obsolete warehouse space. Trendy consumers love eating $20 burgers while looking out a windowed garage door, even if the insulation is questionable on 100 degree summer days!