Right at the end of August, 2023, Knightvest Capital, a vertically integrated multifamily investment company, announced the sale of Reagan at Bear Creek. The 1998-vintage asset was acquired in 2017 as a value-add project. Located in Euless, Texas, the property's remodeling should help maximize the value of its excellent location right next to DFW airport.

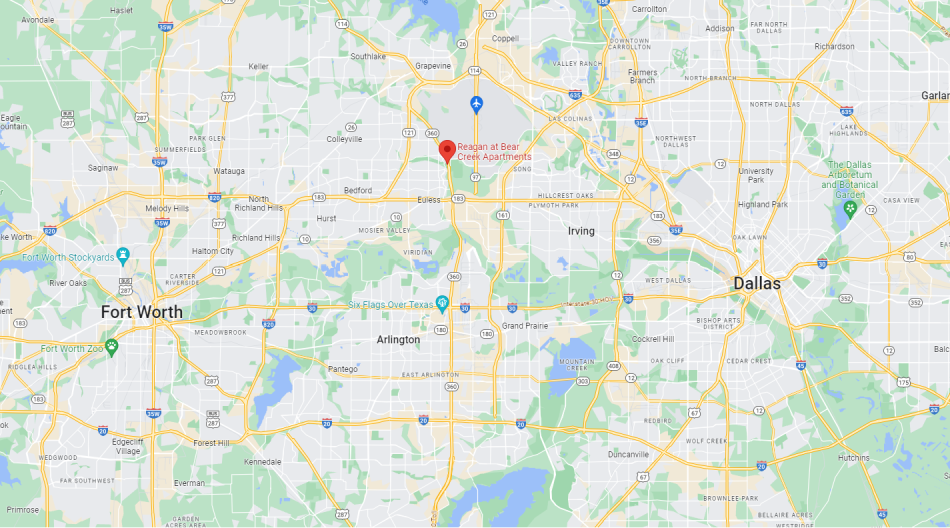

Unfortunately, this location leaves residents with few excuses when it comes to airport pickups/dropoffsSource: Google Maps

Unfortunately, this location leaves residents with few excuses when it comes to airport pickups/dropoffsSource: Google Maps

Knightvest identified the opportunity in Euless by looking at a few factors:

- Low construction volume

- Strong population growth

- Limited supply of high-quality rentals

The company sought to reposition the asset as a luxury multifamily complex. By renovating units with high-quality build-outs and upgrading the amenities, the company was able to achieve a remarkable 80% increase in rents from acquisition to today. David Moore, CEO and Founder of Knightvest, spoke to the company's strategy:

Over the past 15 years, we've refined our strategy and built the winning team that continues to exceed expectations. The sale of this property is a perfect example of the type of outsized returns that can be achieved through our differentiated approach. We've always worked hard to position the company for success regardless of external market dynamics. After two acquisitions in the past several months, this sale is yet another example of how we're focused on staying active through the consistent execution of our strategy

Stainless steel appliances help warrant the rent increasesSource: https://www.reaganatbearcreek.com/gallery/

Stainless steel appliances help warrant the rent increasesSource: https://www.reaganatbearcreek.com/gallery/

Without a doubt, this is an incredible success story. The investors in this asset were able to add value on top of secular growth in the market. Although no further details were shared, it is more than likely the sales value benefitted from cap rate compression since 2017 due to the rapid growth of the market, in spite of rising cost of capital.

That said, investors today probably shouldn't expect to see such incredible value increases without some equally incredible capital expenditures in their value-add plans. While real estate markets, as a result of their asset-specific risk and illiquidity, tend to reward those who take on the risk of value-add projects, such massive rent increases are not sustainable in the long-term.