In June 2023, Moody's Investors Service released a report on the current risks facing CRE investors. Although the report focused primarily upon the debt side of the equation, equity investors should still take note: understanding lenders' situations is essential in determining capital structures before sourcing debt. Beyond debt sourcing, opportunistic investors, both debt and equity alike, may be able to find attractive opportunities. These opportunities may be a bit hairy, so savvy investors should be prepared with metaphorical combs and razors.

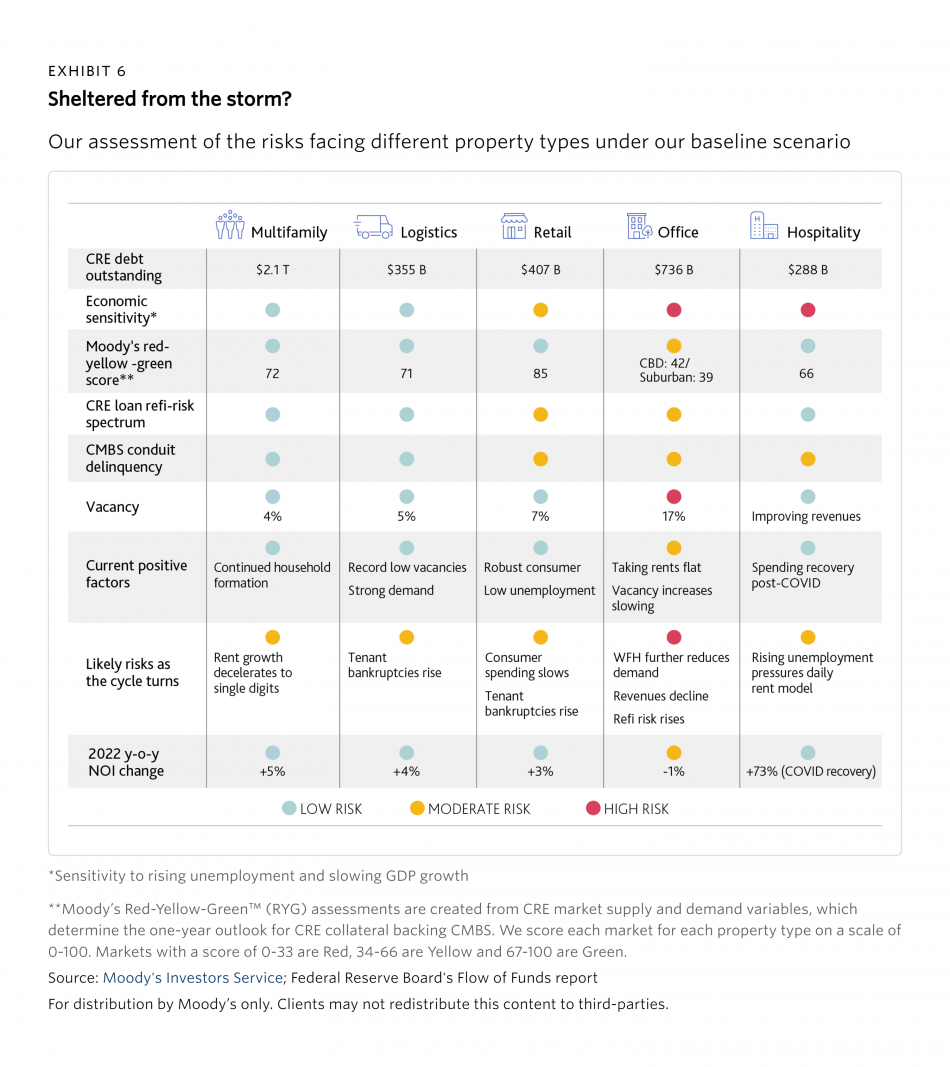

The report, whose full text is linked above, presents a macro-level view of CRE debt markets' condition and outlooks. This includes a breakdown of major CRE asset types and their specific risk sensitivities:

For the first time in years, it seems that hospitality is not facing the most riskSource: Moody's Investors Service

For the first time in years, it seems that hospitality is not facing the most riskSource: Moody's Investors Service

Many of these risks should not come as a surprise. Everyone knows industrial and multifamily should show resilience while retail is at risk and office is struggling. Perhaps most notable is the hospitality space. Hospitality is inherently more cyclical than other asset types since their "leases" are on a daily basis. However, other factors seem to be pointing in the right directions for your friendly neighborhood hotelier.

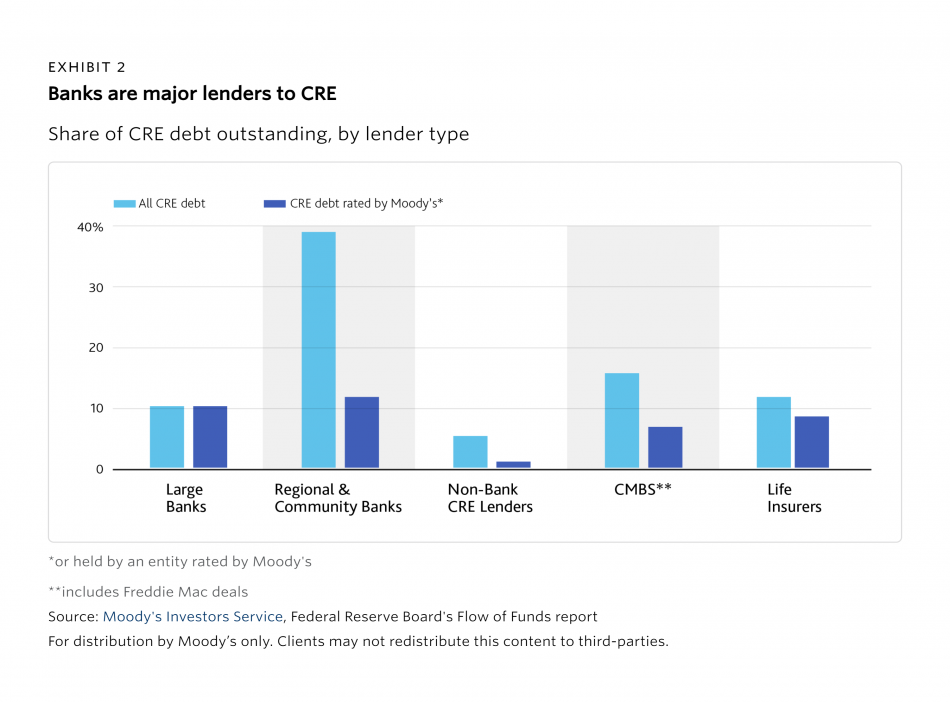

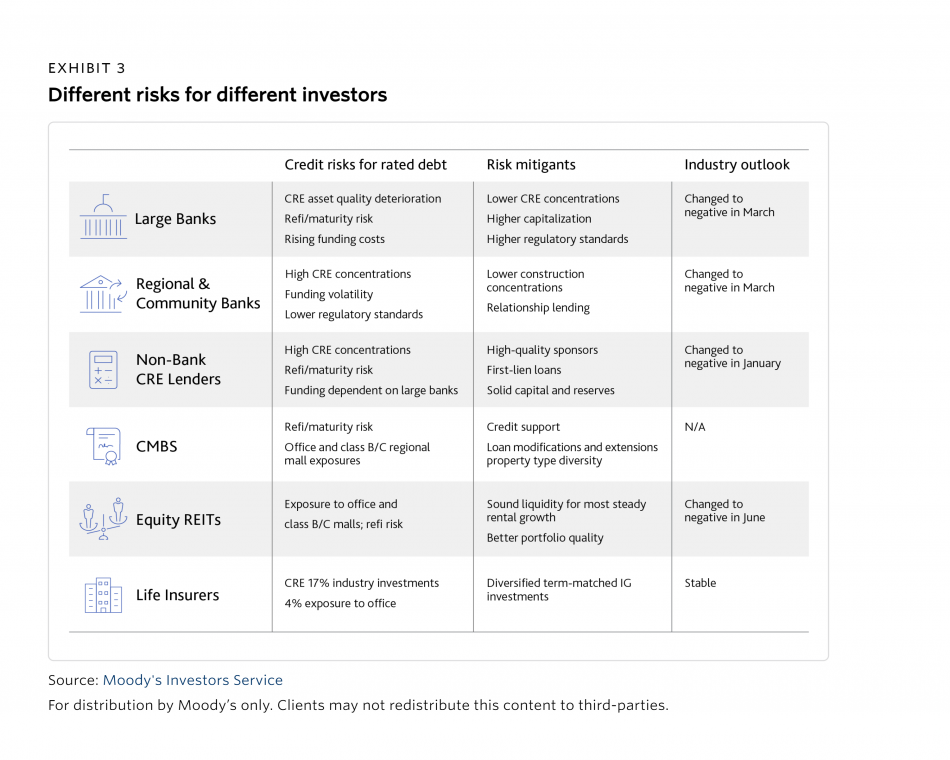

The report also includes a table demonstrating different lenders' risks, risk mitigants, and outlooks. This table covers Moody's $3.49tn (or, more dramatically, $3,490,000,000,000) in rated CRE debt, which makes up 58% of all CRE debt outstanding, plus an additional $300bn in equity REIT debt:

Outlooks look tough across the board, with the exception of life insurersSource: Moody's Investors Service

Outlooks look tough across the board, with the exception of life insurersSource: Moody's Investors Service

Life insurers' inherently conservative investment strategy, including duration-matching to minimize interest rate risk, is likely the main driver behind their stable outlook. Other lenders, however, face less-than-rosy prospects.

Even performing loans face major refinancing risk as borrowers who locked into fixed rate debt face the highest FED funds rate since 2001. The 2010s offered unprecedented low rates, especially directly following Covid. Asset managers who could easily cover debt in the past may be forced to greatly un-lever their properties or risk default. Similarly, $6.2bn of CMBS loans maturing within 2023 and 2024 face refinancing in a new interest rate environment. Office and retail CMBS loans have been the primary drivers in bringing delinquencies to 4.5% in May, 2023.

Equity REIT lenders face similar issues, with rent growth failing to outpace rate debt service. While REITs are well capitalized, their dividend requirements force them to keep limited cash on hand, which may stretch revolving lines of credit if they are forced to increase the equity part of their capital stack at refinancing.

Regional banks, a key part of the CRE ecosystem, face outsized exposure to CRE. Banks with assets between $10-$250bn have, on average, a (non-owner-occupied) CRE loan to tangible common equity ratio of 219%, compared to larger banks' 51%. This is exacerbated by high concentrations in both geographic areas and individual borrowers, as well as continued late-cycle lending.

Moody's considers the risk of bank credit downgrades due to bad loans to be unlikely unless there is a more intense economic turndown than the mild recession forecasted. This is in spite of history showing banks with high CRE exposure to be empirically more likely to fail in the event of downturns. Instead, Moody's believes that tighter underwriting will be the most likely outcome.

For CRE investors, stricter underwriting and higher rates can be a blessing or a curse. For highly levered investors, debt will likely be hard to come while debt coverage requirements will remain daunting. However, for the cash-rich investor with dry powder ready to deploy, there is much opportunity. Expensive debt should, theoretically, lead to less competition for assets while stricter lender underwriting should allow an advantage in time-to-close. Additionally, distressed acquisitions may present themselves as golden tickets for investors correctly positioned to take advantage.