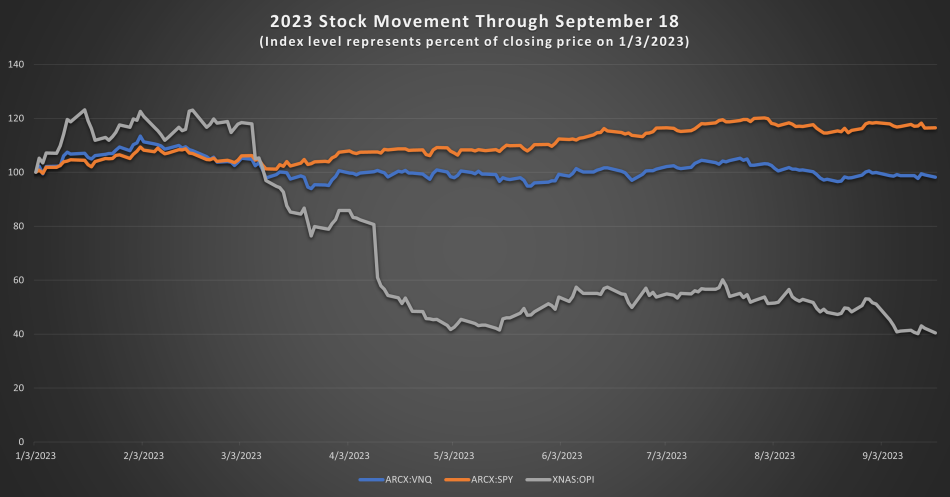

On September 14, 2023, Moody's Investor Service downgraded the office REIT Office Properties Income Trust (NASDAQ: $OPI) to B2 from Ba3. The B2 rating, which meanings "speculative and subject to high credit risk", was given to both OPI's Corporate Family Rating (CFR) and senior unsecured debt. Also downgraded was Select Income REIT's bonds, which were acquired by OPI in their 2018 merger and stand pari-passu with OPI's unsecured debt. Additionally, OPI's Speculative Grade Liquidity (SGL) was downgraded from SGL-3 to SGL-4. The ratings remain under review for further downgrade.

Moody's states the downgrade reflects the REIT's high leverage, facing near-term maturities on its unsecured revolver in January 2024 and a bond maturity in May 2024. Holding $25mm in cash (as of Q2 2023), OPI has a few bills coming up on the horizon:

- $240mm (as of Q2 2023) drawn on the revolver expiring in January 2024

- $350mm in unsecured bonds maturing in May 2024

- $650mm in unsecured bonds maturing in February 2025

Additionally, raising additional capital may be difficult for OPI. Their bonds include a covenant mandating their unencumbered assets be worth at least 1.5x their unsecured debt balance. As of Q2 2023 (3 months ending June 30), this ratio was at 2.062x. Even without considering the possibility of asset write-downs due to the weak office market, this ratio will severely hamper OPI's ability to get more favorable terms through secured debt.

Office Properties' stock dropped $1.01, over 6.9%, from March 9 to March 13 as Silicon Valley Bank was seized by regulators

Office Properties' stock dropped $1.01, over 6.9%, from March 9 to March 13 as Silicon Valley Bank was seized by regulators

As a REIT, OPI is required to disburse the majority of their income as a dividend. This allows shareholders to avoid "double taxation" of traditional corporations where taxes are paid at the corporate level and then once more at the shareholder level. However, this leads to REITs often having little in the way of cash reserves, typically relying upon a revolver for liquidity purposes. After over a decade of unprecedented low interest rates, the rising cost of this debt has put pressure on all levered businesses.

In Q2 2023 alone, OPI paid $26.525mm in interest, over 20% of their total operating expenses of $116.844mm. Rental income of only $133.997mm led to a net loss of $12.242mm for the quarter, or about 25 cents per share. The prospect of increasing cost of debt is certainly worrisome for OPI equity owners. On September 4, OPI terminated its merger agreement with Diversified Healthcare Trust (NASDAQ: $DHC), another REIT that also received a ratings downgrade on September 14 (down to Ca from Caa3). In preparation for the merger, OPI had closed four loans worth $108.1mm to pay down their revolver. Since the merger has been called off, these mortgages will hopefully provide some liquidity breathing room.