On June 5, 2024, Hilco Real Estate Sales, a real estate advisory firm whose expertise includes bankruptcy services, announced the sale of a 4.2-acre site in Wylie, Texas. Located on State Highway 78, the site is shovel-ready for the development of 34 townhomes. The sale is a result of an order by the US Bankruptcy Court Eastern District of Texas regarding Serene District Townhomes, LLC. Interested buyers must submit their bids by July 19.

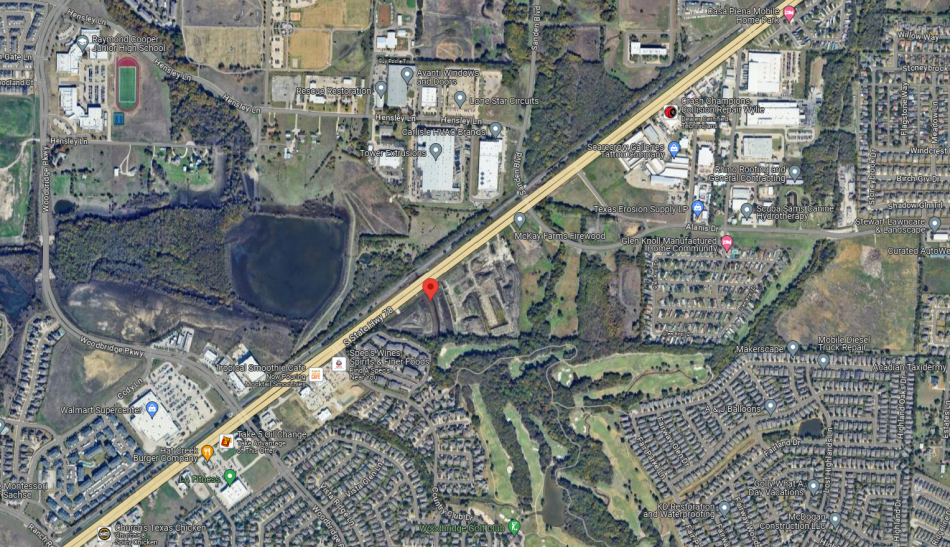

The site certainly is not an unattractive spot for development. As illustrated by the above satellite imagery, the surrounding area is flush with both residential and retail development. Hilco indicates the Planned Development District zoning allows for commercial development, taking full advantage of the highway frontage offered by the parcel. Steve Madura, senior vice president at Hilco, spoke to the benefits of the location:

This prime parcel in Wylie represents a remarkable opportunity for developers and investors. The combination of shovel-ready status, flexible development options, and strategic location within the rapidly growing Dallas-Fort Worth MSA makes this property exceptionally desirable.

The sale's inclusion of development and engineering plans may make prospective buyers reluctant to stray from the existing townhouse plans. These townhouse plans include the following:

- 14 units | 3-bed/3-bath

- 20 units | 3-bed/2.5-bath

- Attached 2-car garages

- Community center

- Pool & recreational sports areas

Despite being a relatively small development, this bankruptcy sale should not be dismissed. The circumstances of the bankruptcy are unclear but both macro-scale capital markets and the DFW market seem to imply this may become a more common occurrence. The supply of housing The Metroplex has exploded to meet the demand from population growth. However, especially in outer suburbs such as Wylie, there is a threat of oversupply (or overly optimistic NOI growth assumptions), testing developers' appetite for risk.

Equity investors' intestinal fortitude may come up short in attracting other parts of the capital stack, leading to bankruptcies like this. Regional banks remain under pressure and largely over-exposed to commercial real estate. Additionally, elevated interest rates allowed investors to enjoy healthy yields from assets lower on the risk spectrum. These factors, among others, may lead to available capital drying up, a recipe for bankruptcy should there be a need for refinancing. Investors should keep a keen eye on their own liquidity as well as potential opportunities resulting from distressed assets.