On September 26, 2023, S&P published their latest data for the Case-Shiller Dallas Home Price NSA Index. The results will likely not be shocking to anyone: Dallas home prices have continued to rise. Continued growth of The Metroplex has provided the housing market with tailwinds sufficient to brush off rising rates.

The Case-Shiller index is meant to purely capture the price of homes while controlling for other factors such as quality and location. It is a "repeat sale index", deriving values from properties that have traded multiple times to avoid the need to adjust for property-level factors. Changes in asset quality or physical characteristics are also accounted for, meaning renovated homes will not skew the index upward. Full methodology is available on the S&P website.

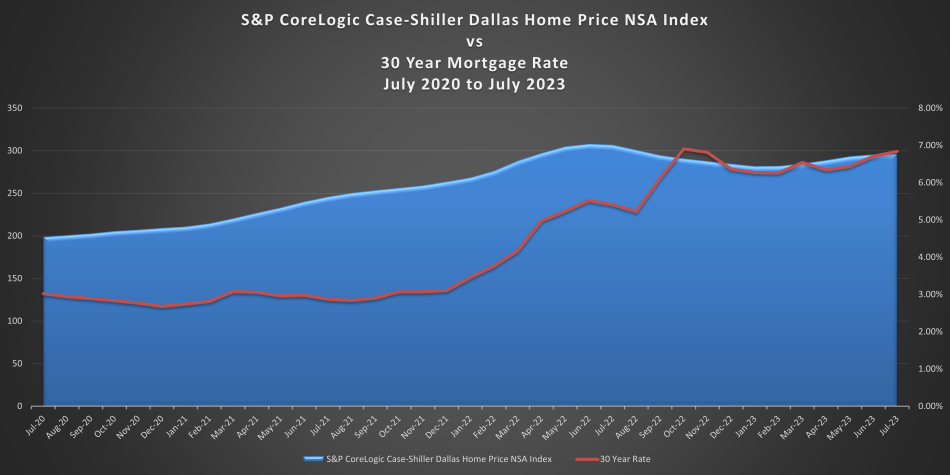

Over the past 3 years, Dallas home prices have seen an annualized 14.21% rate of increaseSource: S&P

Over the past 3 years, Dallas home prices have seen an annualized 14.21% rate of increaseSource: S&P

The facts speak for themselves: since July 2020, mortgage rates have more than doubled from 3.02% to 6.84%. Despite this, home prices are a dramatic 50% higher than when money was cheap, evidenced by the index moving from 198.78 to 296.14. In June 2022, the index reached its peak at 307.81, later falling to a local minimum of 281.71 in January 2023.

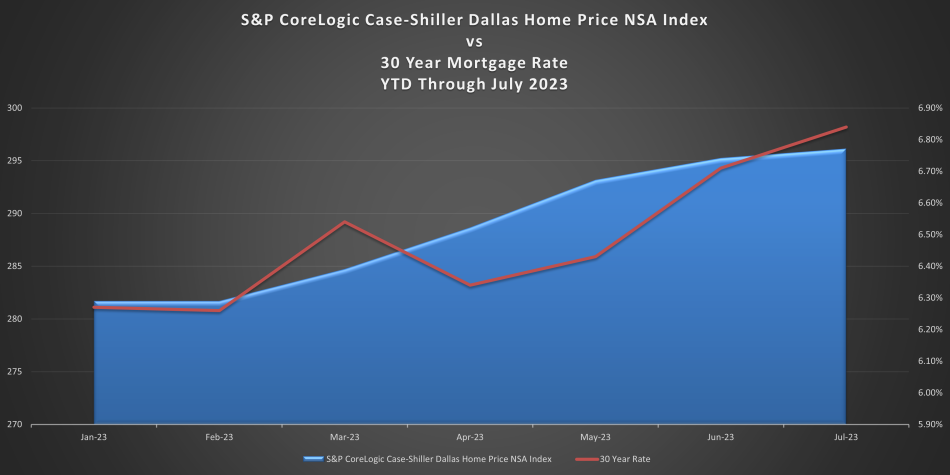

Undeterred by ever-higher rates, Dallas home prices have increased following their slump in the second half of 2022Source: S&P

Undeterred by ever-higher rates, Dallas home prices have increased following their slump in the second half of 2022Source: S&P

Despite ubiquitous construction crews working hard to bring new supply to market, it seems as if the DFW housing market is heating up back to its 2022 highs. With new additions to the skyline on the horizon, such as Goldman Sachs' campus near American Airlines Center, there is a strong case to be made for housing prices being justified based on solid fundamentals: increased growth of high-paying jobs will drive all housing in the area up.

Is this a resilient bubble, a justified appreciation of value, or something in between? Let us know in the comments!