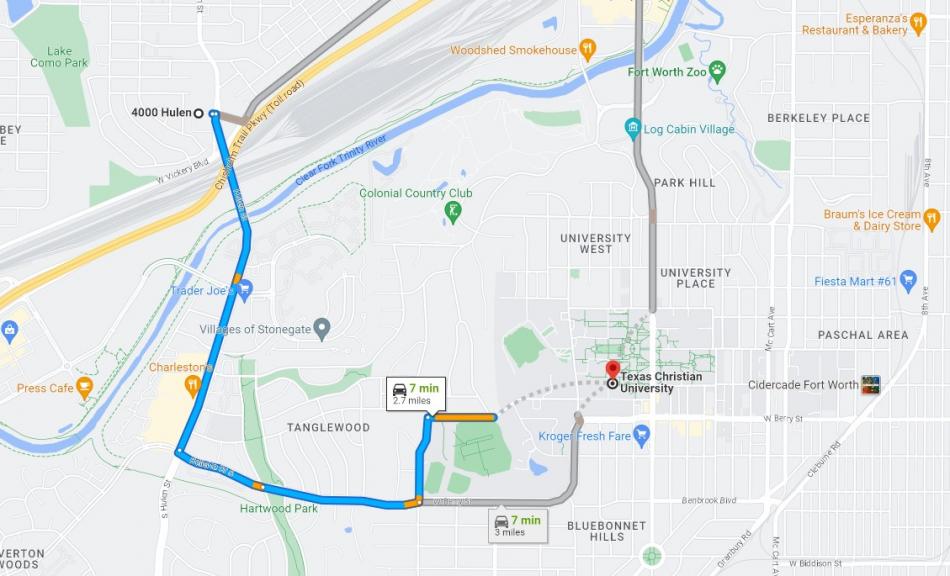

San Francisco real estate investment firm Hamilton Zanze recently announced the sale of the 4000 Hulen apartments in Fort Worth. The creatively named property, located at 4000 Hulen St, boasts 240 units with an impressive average 886 SF per unit, equating to approximately 200,000 rentable SF.

Hamilton Zanze initially acquired the property in 2017 and, despite the property having only been built in 2015, followed a value-add strategy. Unit renovations included new backsplashes, appliances, and hardware. Additionally, community amenities were upgraded. The modernized units combined with the pool, fitness center, coffee bar, billiards table, and dog park have allowed for improved occupancy and increases in rent rates. While these renovations and amenities have clearly driven growth for the asset, we can only hope the new buyer recognizes the importance of pickleball courts in any modern apartment.

4000 Hulen is in a prime location: local employers include TCU, Plaza Medical Center, and Cook Children's Medical Center. It is likely that TCU in particular is a major strength of the asset, offering both local employment and a large student demographic.

Since it was purchased in 2017, 4000 Hulen likely benefited from both the value add project and cap rate compression. Anthony Ly, director of dispositions at Hamilton Zanze, spoke to the business strategy:

The Dallas/Fort Worth metro continues to thrive with strong population growth. We were able to purchase 4000 Hulen below replacement cost and increase the property's value through strong property management. We are glad to have executed on the sale and deliver a positive outcome to our investors.

He is not the first Californian to enjoy Texas' business environment nor will he be the last.

The Metroplex's multifamily market continues to benefit from strong economic and population growth. Despite constant ground-up development, demand continues to outpace supply, making stabilized assets such as 4000 Hulen a very attractive proposition for institutional investors.