Note: This article was originally written on 1/7/2023 and information may be dated as of publishing.

The past few years have been a bizarre time for financial markets. After more than a decade of all-time low interest rates and inflation constantly below the 2% target, Covid's further rate cuts and stimulus spending did not immediately disrupt the relative macroeconomic tranquility. Asset prices saw a massive rally as money was cheap, growth projections were strong, and the stock market became essentially a casino driven by mass market manipulation (see: Gamestop short squeeze). This rally proved to be a short-lived bubble when inflation reared its ugly head toward the second half of 2021. Hindsight is 20:20, but a screenshot of the first ever tweet selling for $2.9 million was probably the best indicator of an unsustainable market that an investor could ask for.

For many investors, this has been a harsh reality check. Increasing discount rates have slashed the valuations of unprofitable companies and inflation, especially in Europe, has demonstrated that no amount of quantitative easing will provide the gas to heat your home.

Real estate valuations have not had such a dramatic correction. However, investors should be aware of potential risks they may face at the time of disposition or refinancing. Real estate, especially commercial real estate, in inherently illiquid and heterogenous compared to stocks, bonds, or commodities. On top of that, many real estate indices are transaction based -- if no one is willing to sell at fair market values, these indices will not be reflective of the fair market value.

One of the key reasons for the "Covid asset bubble" was the near-zero FED funds rate. Searching for yield in a low-inflation environment, investors simultaneously applied low discount rates and took positions in risky projects/securities to secure meaningful returns. While the NFT and Metaverse markets are an extreme example of this, real estate owners should be wary of the threat of a similar correction.

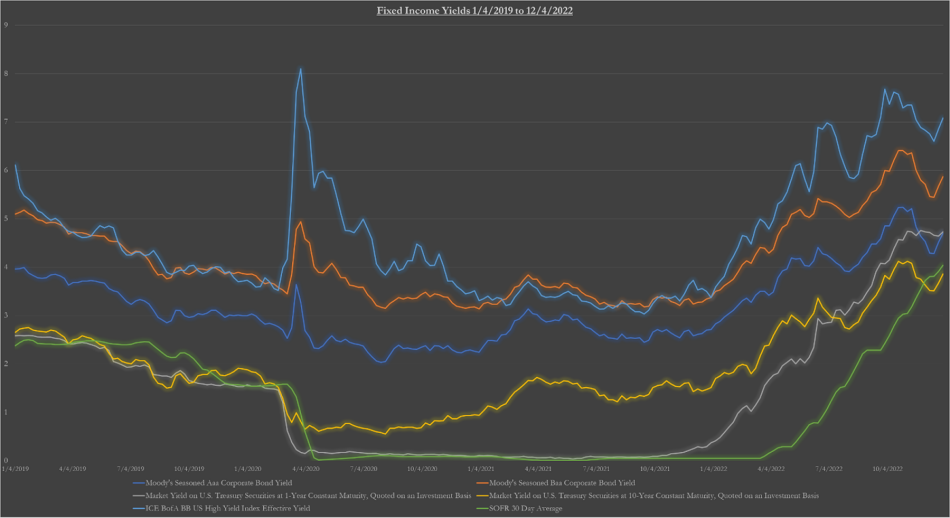

Today's risk-adjusted yields would make a 2021 investor blush. US Treasuries as of October 2022 offer a greater yield than junk bonds did in 2021. While this is enticing to investors with dry powder ready to deploy, it should raise concerns to those with high exposure to assets bought in the past few years. The constant cap rate compression that has driven value appreciation is not likely to persist.

A cap rate is calculated using two components: [Cost of Capital] minus [Expected NOI Growth]. The fixed income chart above demonstrates that the cost of debt capital is going up across the board. Since debt investors have a host of increasing yields at all ends of the risk-spectrum, real estate will have to, in turn, offer greater returns in order to attract debt capital. Similarly, equity investors, such as limited partners, will likely demand greater returns.

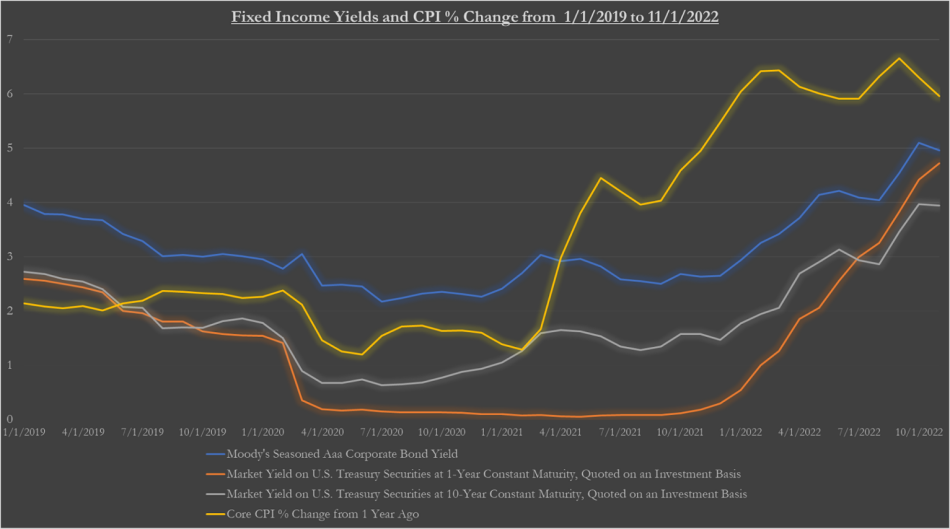

For stock equity investors, inflation has driven up discount rates in valuations and slashed valuations. Core CPI does not include volatile commodities such as food and fuel, so the CPI component of the above chart can be seen as a proxy for inflation. Even if investors were to hold their required real rate of return constant, their required nominal rate of return would have to increase due to inflation. Since the GFC in 2008, the economy has enjoyed both abnormally low interest rates and inflation, driving discount rates lower and potentially creating a blind spot in investors' risk assessments.

Both inflation and corrections to more favorable valuations in other markets will drive up the cost of capital for real estate investors, causing the first part of the cap rate equation to move against current valuations.

Projected NOI growth is the latter part of the cap rate equation. While inflation certainly pressures nominal NOI up, real NOI growth strongly driven by economic expansion. With increasing cost of capital across the board, economic growth is likely to be hampered. This increase in cost of capital will lead companies to reevaluate their need for expansion, reducing opportunities for development and reducing competition for space when determining market lease rates. Beyond that, cash strapped tenants may find themselves defaulting on their leases, leading to nominal NOI declines.

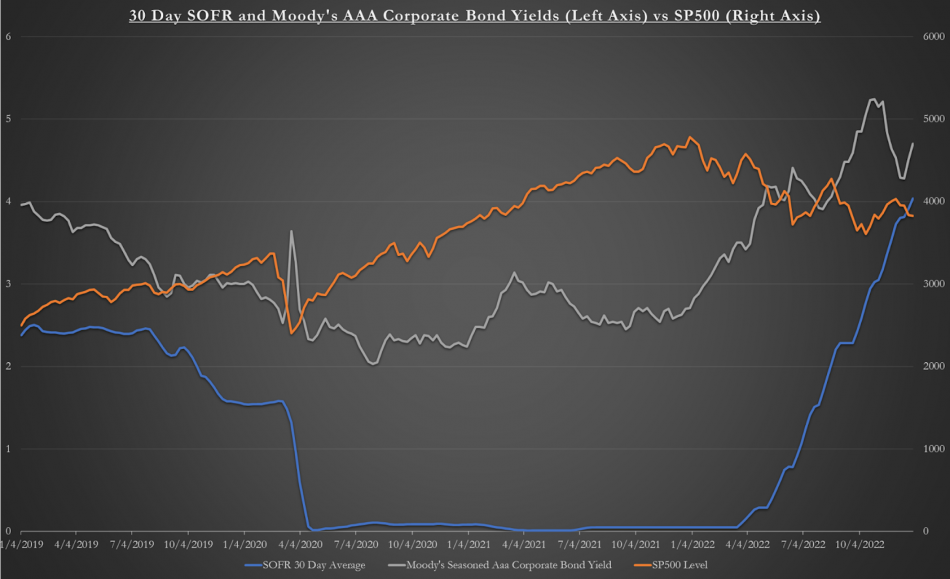

As the Secured Overnight Financing Rate (SOFR) has risen, the S&P 500 index has declined and investment grade bond yields have risen. This should be a concern even for commercial real estate owners with long term financing in place, especially those with floating rate debt. Rising rates and potential vacancies could cause even conservative investors to run afoul of debt covenants. Investors with large exposure to speculative assets could even face insolvency as debt coverage drops in tandem with floating rates increasing.

Tumultuous markets can be a great opportunity for investors, with real estate being no except. However, lagged market data due to illiquidity in real estate markets can lead to inaccurate perceptions of current market values. The Dallas market is likely to show more resiliency than many due to its strong growth and diversified economy. That said, the macro environment is showing a strong risk of correction in the real estate market -- something that every investor should be prepared for.