Cheap money makes assets more expensive, right? A decade of unprecedented low rates, spurred on by a perfect storm of fiscal and monetary stimulus for Covid, reached a breaking point in 2021. Inflation reached levels not seen since the 1980s forced Jay Powell's hand: the Fed Funds Rate has been hiked to over 5.00% from its trough of 0.06% in May of 2021. For commercial real estate owners and lenders, this has led to concerns: low interest fixed-rate mortgages will lead to debt coverage issues upon refinancing. The increased debt service and required equity to meet DSCR requirements draw valuations into question. Single family homes, however, have not seen such a correction, leaving homeownership out of reach for millions of Americans.

It makes sense that home values have remained sky-high in many markets. Markets such as The DFW Metroplex offer strong secular tailwinds such as both economic and population growth, forcing valuations upward as more people with more money bid for the same number of homes. However, on a national scale it is evident that home values are holding steady. There too many factors to list, but a few possibilities include:

- Homeowners are reluctant to sell for a loss

- Homeowners with low, fixed-rate mortgages are reluctant to sell and be forced to originate a new mortgage at today's rates

- Covid increased the desirability of a private home

- Historically low levels of new supply was brought to market in the wake of the 2008 crash

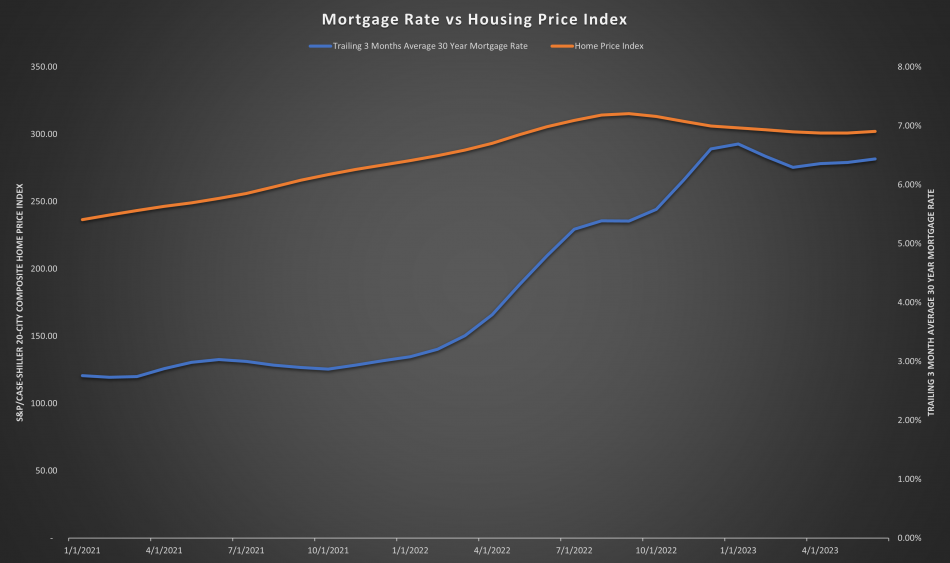

Home values seem to have stabilized after rate hikes, but they remain elevated out of many prospective buyers' budgetsSource: FRED

Home values seem to have stabilized after rate hikes, but they remain elevated out of many prospective buyers' budgetsSource: FRED

The chart above shows the S&P/Case-Shiller 20-City Composite Home Price Index plotted against the average trailing 3-month 30-Year Fixed Rate Mortgage Average rate. Despite the average mortgage rate more than doubling, home values have shown resilience, leveling off without any substantial decreases following the rate hikes.

Decreased asset values (outside of SFR real estate) would, in theory, make down payments more difficult to come up with. The liquidity issue of down payments is compounded by the rates themselves as leverage becomes more and more expensive.

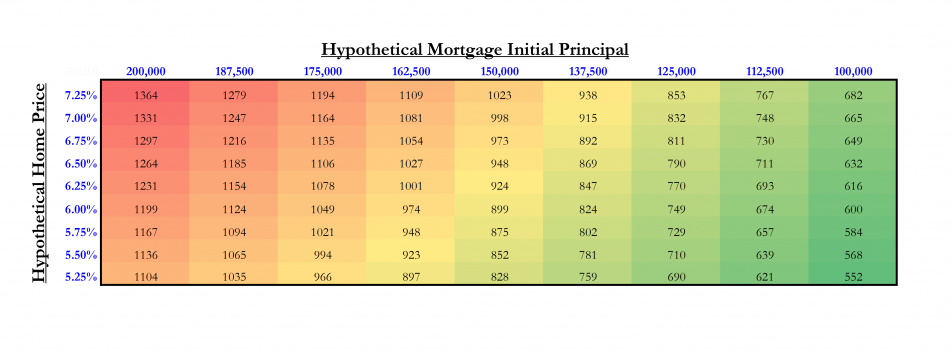

High values and high rates don't tend to mix well -- just a handful of basis points can put payments out of prospective homebuyers' budgets.

Note these hypothetical principal amounts were used for ease of demonstration -- don't expect to get such a cheap home in this market. Source: I spend too much time in Excel

High values and high rates don't tend to mix well -- just a handful of basis points can put payments out of prospective homebuyers' budgets.

Note these hypothetical principal amounts were used for ease of demonstration -- don't expect to get such a cheap home in this market. Source: I spend too much time in Excel

Who says the American dream is dead?

Investors have taken notice of the lack of affordability. Build-to-rent projects seem to be a dime a dozen as sophisticated investors with access to capital seek to capitalize (pun intended) upon the demand for homes. That said, don't buy too much into the doom-and-gloom headlines about the United States becoming a "nation of renters": homebuilders have also taken notice and are working to bring new supply to market. A quick look outside is all the anecdotal confirmation I need to know there's plenty of empty dirt in this country that will put dollar signs in savvy homebuilders' eyes.

While it may not be the best time to buy a home, CRE investors should keep an eye on the market. Single family residential build-to-rent (SFR-BTR) communities may prove less attractive than homeownership if supply is increased to satiate the demand for homes. Time may prove BTR communities, with the potential for high resident-turnover, miss out on the positive externalities associated with a cohesive neighborhood of homeowners. A block party hosted by your landlord probably isn't as enjoyable as one organized by the neighbors who have lived on the block for decades

Multifamily investors should join SFR-BTR investors in keeping housing supply in mind throughout their underwriting. The potential for both SFR values and mortgage rates to drop in the near future may throw a wrench in rent growth assumptions as tenants find alternatives to be affordable.

In the end, the United States is a big place with plenty of space to build and plenty of investors wanting to get rich. Both the affordability factor and potential for new supply put the housing market on thin ice. Investors should not be surprised by volatility in the near future.